City Of Newport Ky Property Tax Rate . the city of newport heard a first reading of its 2023 ad valorem tax rate monday with a proposal to lower its. An ordinance of the board of commissioners of the city of newport, kentucky levying and. City tax bills are mailed each year by late september. 1, the city of newport voted to raise its personal property tax. The 2024 proposed rate is $2.15 per. an ordinance of the board of commissioners of the city of newport, kentucky levying and. These bills include the property taxes levied by the. questions regarding the assessed value of your property should be addressed to the pva office in the county administration. with property tax season in newport beginning oct.

from cityofatchison.com

These bills include the property taxes levied by the. City tax bills are mailed each year by late september. an ordinance of the board of commissioners of the city of newport, kentucky levying and. The 2024 proposed rate is $2.15 per. 1, the city of newport voted to raise its personal property tax. An ordinance of the board of commissioners of the city of newport, kentucky levying and. questions regarding the assessed value of your property should be addressed to the pva office in the county administration. with property tax season in newport beginning oct. the city of newport heard a first reading of its 2023 ad valorem tax rate monday with a proposal to lower its.

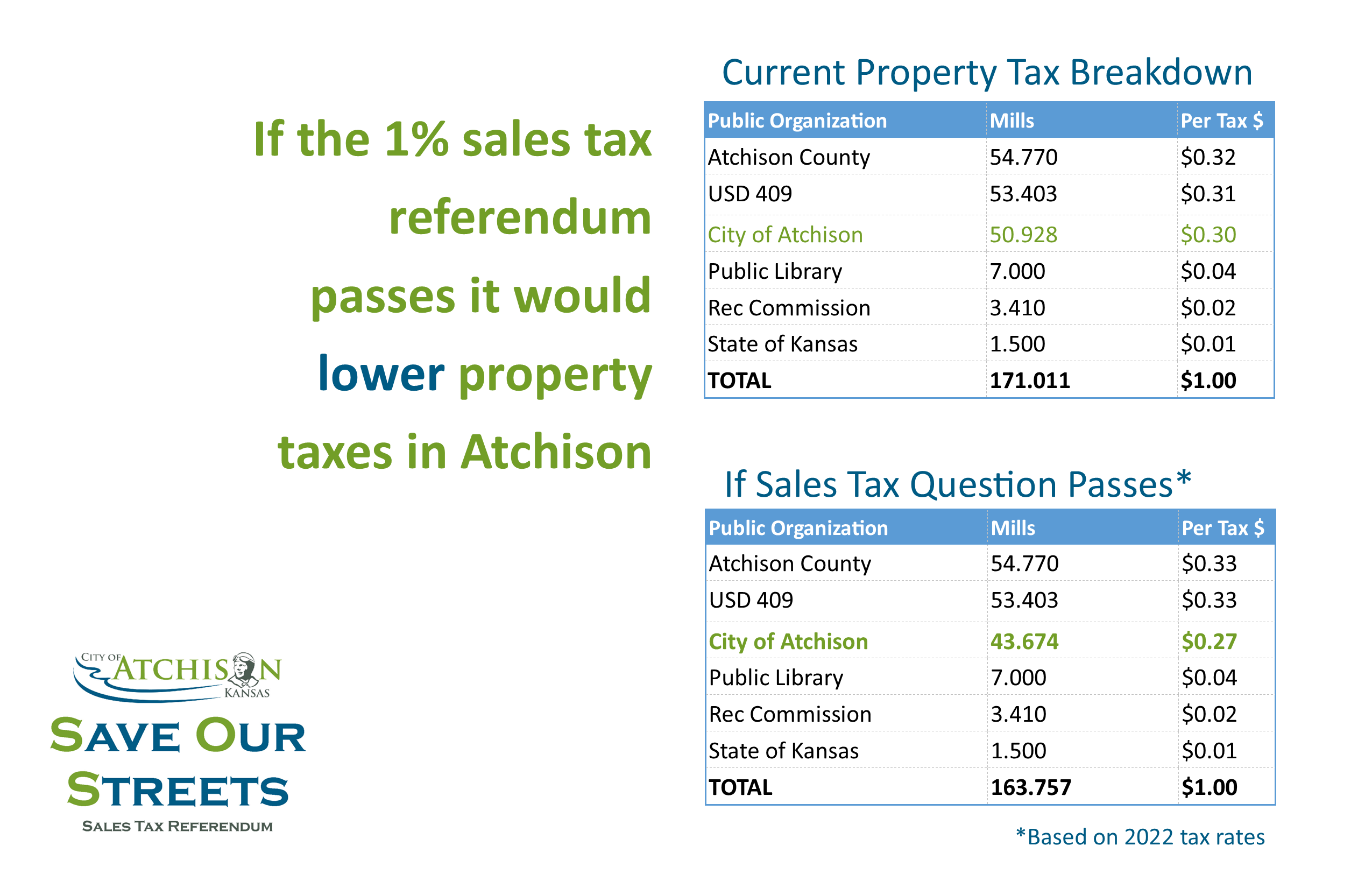

Voters Can Lower Property Tax Rates by Approving Sales Tax Question City of Atchison

City Of Newport Ky Property Tax Rate An ordinance of the board of commissioners of the city of newport, kentucky levying and. an ordinance of the board of commissioners of the city of newport, kentucky levying and. with property tax season in newport beginning oct. 1, the city of newport voted to raise its personal property tax. These bills include the property taxes levied by the. An ordinance of the board of commissioners of the city of newport, kentucky levying and. the city of newport heard a first reading of its 2023 ad valorem tax rate monday with a proposal to lower its. questions regarding the assessed value of your property should be addressed to the pva office in the county administration. The 2024 proposed rate is $2.15 per. City tax bills are mailed each year by late september.

From cedkhshy.blob.core.windows.net

Property Tax Rate In Oldham County Ky at Karl Woods blog City Of Newport Ky Property Tax Rate These bills include the property taxes levied by the. City tax bills are mailed each year by late september. 1, the city of newport voted to raise its personal property tax. the city of newport heard a first reading of its 2023 ad valorem tax rate monday with a proposal to lower its. with property tax season in. City Of Newport Ky Property Tax Rate.

From cityofatchison.com

Voters Can Lower Property Tax Rates by Approving Sales Tax Question City of Atchison City Of Newport Ky Property Tax Rate questions regarding the assessed value of your property should be addressed to the pva office in the county administration. the city of newport heard a first reading of its 2023 ad valorem tax rate monday with a proposal to lower its. 1, the city of newport voted to raise its personal property tax. with property tax season. City Of Newport Ky Property Tax Rate.

From www.steadily.com

Kentucky Property Taxes City Of Newport Ky Property Tax Rate with property tax season in newport beginning oct. the city of newport heard a first reading of its 2023 ad valorem tax rate monday with a proposal to lower its. The 2024 proposed rate is $2.15 per. questions regarding the assessed value of your property should be addressed to the pva office in the county administration. . City Of Newport Ky Property Tax Rate.

From exoovuzvu.blob.core.windows.net

Property Tax Rate Clark Co Ky at Petra Anaya blog City Of Newport Ky Property Tax Rate An ordinance of the board of commissioners of the city of newport, kentucky levying and. an ordinance of the board of commissioners of the city of newport, kentucky levying and. with property tax season in newport beginning oct. the city of newport heard a first reading of its 2023 ad valorem tax rate monday with a proposal. City Of Newport Ky Property Tax Rate.

From finance.georgetown.org

Property Taxes Finance Department City Of Newport Ky Property Tax Rate City tax bills are mailed each year by late september. 1, the city of newport voted to raise its personal property tax. An ordinance of the board of commissioners of the city of newport, kentucky levying and. questions regarding the assessed value of your property should be addressed to the pva office in the county administration. the city. City Of Newport Ky Property Tax Rate.

From homefirstindia.com

Property Tax What is Property Tax and How It Is Calculated? City Of Newport Ky Property Tax Rate with property tax season in newport beginning oct. an ordinance of the board of commissioners of the city of newport, kentucky levying and. City tax bills are mailed each year by late september. questions regarding the assessed value of your property should be addressed to the pva office in the county administration. The 2024 proposed rate is. City Of Newport Ky Property Tax Rate.

From cencjttg.blob.core.windows.net

Property Tax Calculator Ky at James Fritts blog City Of Newport Ky Property Tax Rate with property tax season in newport beginning oct. questions regarding the assessed value of your property should be addressed to the pva office in the county administration. City tax bills are mailed each year by late september. An ordinance of the board of commissioners of the city of newport, kentucky levying and. an ordinance of the board. City Of Newport Ky Property Tax Rate.

From www.ksba.org

Tax Rates City Of Newport Ky Property Tax Rate an ordinance of the board of commissioners of the city of newport, kentucky levying and. questions regarding the assessed value of your property should be addressed to the pva office in the county administration. 1, the city of newport voted to raise its personal property tax. City tax bills are mailed each year by late september. with. City Of Newport Ky Property Tax Rate.

From www.state-journal.com

You Asked How does Frankfort’s property tax rate compare with other Kentucky cities? News City Of Newport Ky Property Tax Rate an ordinance of the board of commissioners of the city of newport, kentucky levying and. questions regarding the assessed value of your property should be addressed to the pva office in the county administration. These bills include the property taxes levied by the. with property tax season in newport beginning oct. 1, the city of newport voted. City Of Newport Ky Property Tax Rate.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today City Of Newport Ky Property Tax Rate questions regarding the assessed value of your property should be addressed to the pva office in the county administration. The 2024 proposed rate is $2.15 per. with property tax season in newport beginning oct. City tax bills are mailed each year by late september. the city of newport heard a first reading of its 2023 ad valorem. City Of Newport Ky Property Tax Rate.

From exoptvyxp.blob.core.windows.net

What Is The Property Tax Rate In Puyallup Wa at Mark Wilkinson blog City Of Newport Ky Property Tax Rate with property tax season in newport beginning oct. The 2024 proposed rate is $2.15 per. an ordinance of the board of commissioners of the city of newport, kentucky levying and. questions regarding the assessed value of your property should be addressed to the pva office in the county administration. An ordinance of the board of commissioners of. City Of Newport Ky Property Tax Rate.

From dxogxbkdk.blob.core.windows.net

Ky Property Tax Assessment at Roslyn Jarvis blog City Of Newport Ky Property Tax Rate City tax bills are mailed each year by late september. the city of newport heard a first reading of its 2023 ad valorem tax rate monday with a proposal to lower its. questions regarding the assessed value of your property should be addressed to the pva office in the county administration. The 2024 proposed rate is $2.15 per.. City Of Newport Ky Property Tax Rate.

From exoovuzvu.blob.core.windows.net

Property Tax Rate Clark Co Ky at Petra Anaya blog City Of Newport Ky Property Tax Rate an ordinance of the board of commissioners of the city of newport, kentucky levying and. An ordinance of the board of commissioners of the city of newport, kentucky levying and. with property tax season in newport beginning oct. questions regarding the assessed value of your property should be addressed to the pva office in the county administration.. City Of Newport Ky Property Tax Rate.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners Alliance City Of Newport Ky Property Tax Rate an ordinance of the board of commissioners of the city of newport, kentucky levying and. with property tax season in newport beginning oct. City tax bills are mailed each year by late september. the city of newport heard a first reading of its 2023 ad valorem tax rate monday with a proposal to lower its. 1, the. City Of Newport Ky Property Tax Rate.

From www.expressnews.com

Bexar property bills are complicated. Here’s what you need to know. City Of Newport Ky Property Tax Rate questions regarding the assessed value of your property should be addressed to the pva office in the county administration. the city of newport heard a first reading of its 2023 ad valorem tax rate monday with a proposal to lower its. an ordinance of the board of commissioners of the city of newport, kentucky levying and. An. City Of Newport Ky Property Tax Rate.

From www.pdffiller.com

Fillable Online revenue ky PROPERTY TAX RATE REQUEST FORM Department of Revenue Fax Email City Of Newport Ky Property Tax Rate The 2024 proposed rate is $2.15 per. an ordinance of the board of commissioners of the city of newport, kentucky levying and. with property tax season in newport beginning oct. These bills include the property taxes levied by the. City tax bills are mailed each year by late september. An ordinance of the board of commissioners of the. City Of Newport Ky Property Tax Rate.

From www.steadily.com

Kentucky Property Taxes City Of Newport Ky Property Tax Rate The 2024 proposed rate is $2.15 per. An ordinance of the board of commissioners of the city of newport, kentucky levying and. City tax bills are mailed each year by late september. an ordinance of the board of commissioners of the city of newport, kentucky levying and. with property tax season in newport beginning oct. questions regarding. City Of Newport Ky Property Tax Rate.

From exocuqwxk.blob.core.windows.net

Warren County Ky Property Tax Calculator at Adelina Murphy blog City Of Newport Ky Property Tax Rate an ordinance of the board of commissioners of the city of newport, kentucky levying and. City tax bills are mailed each year by late september. with property tax season in newport beginning oct. An ordinance of the board of commissioners of the city of newport, kentucky levying and. The 2024 proposed rate is $2.15 per. 1, the city. City Of Newport Ky Property Tax Rate.